Lynx ISO 20022 message specifications

The following ISO 20022 message specifications for Lynx, Canada’s new high-value payment system, support financial institution participants in developing their own ISO 20022 enabled internal systems, so they can generate and process customer and financial institution wire payments in Lynx.

Please email ISO20022@payments.ca for supporting information or questions.

Lynx core messages:

Lynx ISO 20022 message specification companion document for core messages (pdf)

Lynx business application header (head.001) (pdf)

Lynx business application header (head.001)(excel)

Lynx FI to FI customer credit transfer (pacs.008)(pdf)

Lynx FI to FI customer credit transfer (pacs.008)(excel)

Lynx financial institution credit transfer (pacs.009 core)(pdf)

Lynx financial institution credit transfer (pacs.009 core)(excel)

Lynx financial institution credit transfer (pacs.009 cov)(pdf)

Lynx financial institution credit transfer (pacs.009 cov)(excel)

Lynx payment return (pacs.004)(pdf)

Lynx payment return (pacs.004)(excel)

Lynx reporting messages:

Lynx bank to customer statement (camt.053)(pdf)

Lynx bank to customer statement (camt.053)(excel)

Lynx ISO 20022 message specifications - addendum to camt.053 (pdf)

Lynx ISO 20022 corporate to bank message guidelines:

(For information purposes only)

**The purpose of sharing these guidelines is to provide the industry with guidance for formatting ISO 20022 messages between Financial Institutions and Corporates that aligns with the Lynx ISO 20022 interbank Payments Clearing and Settlement (pacs) messages and global best practices. These guidelines are for information purposes only and Payments Canada accepts no responsibility for any consequence arising from the use of these documents. The documents are subject to change without notice. It is recommended that the corporate consults with their financial institution(s) for their implementation guidelines.**

Lynx ISO 20022 message guideline companion document for corporate to bank messages

Customer credit transfer initiation V09 (pain.001.001.09)(pdf)

Customer credit transfer initiation V09 (pain.001.001.09)(excel)

Customer payment status report V10 (pain.002.001.10)(pdf)

Customer payment status report V10 (pain.002.001.10)(excel)

Bank to customer account report V08 (camt.052.001.08)(pdf)

Bank to customer account report V08 (camt.052.001.08)(excel)

Bank to customer statement V08 (camt.053.001.08)(pdf)

Bank to customer statement V08 (camt.053.001.08)(excel)

Bank to customer debit credit notification V08 (camt.054.001.08)(pdf)

Bank to customer debit credit notification V08 (camt.054.001.08)(excel)

If you are a Lynx participant or vendor and would like a copy of the relevant .xsd files, please contact us at ISO20022@payments.ca.

ISO 20022 Message Flows for Lynx

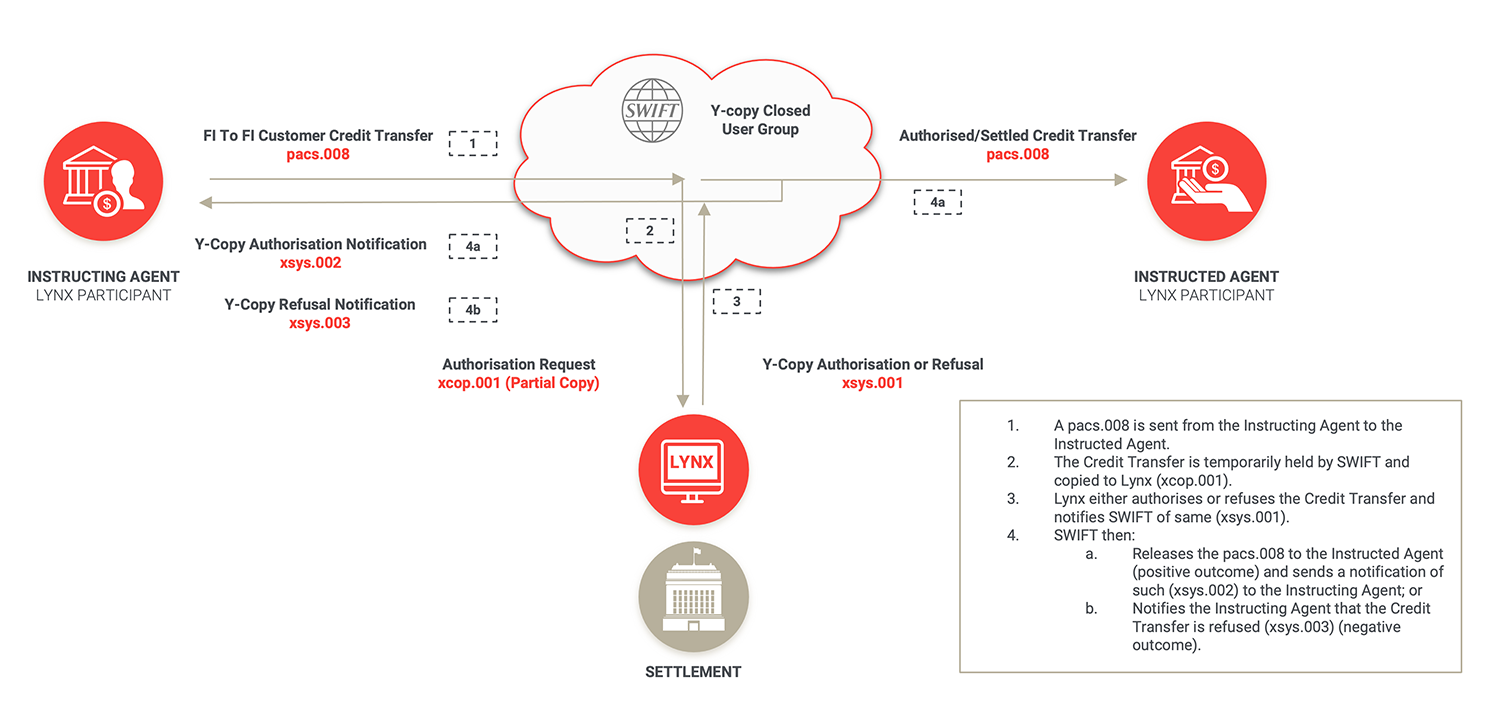

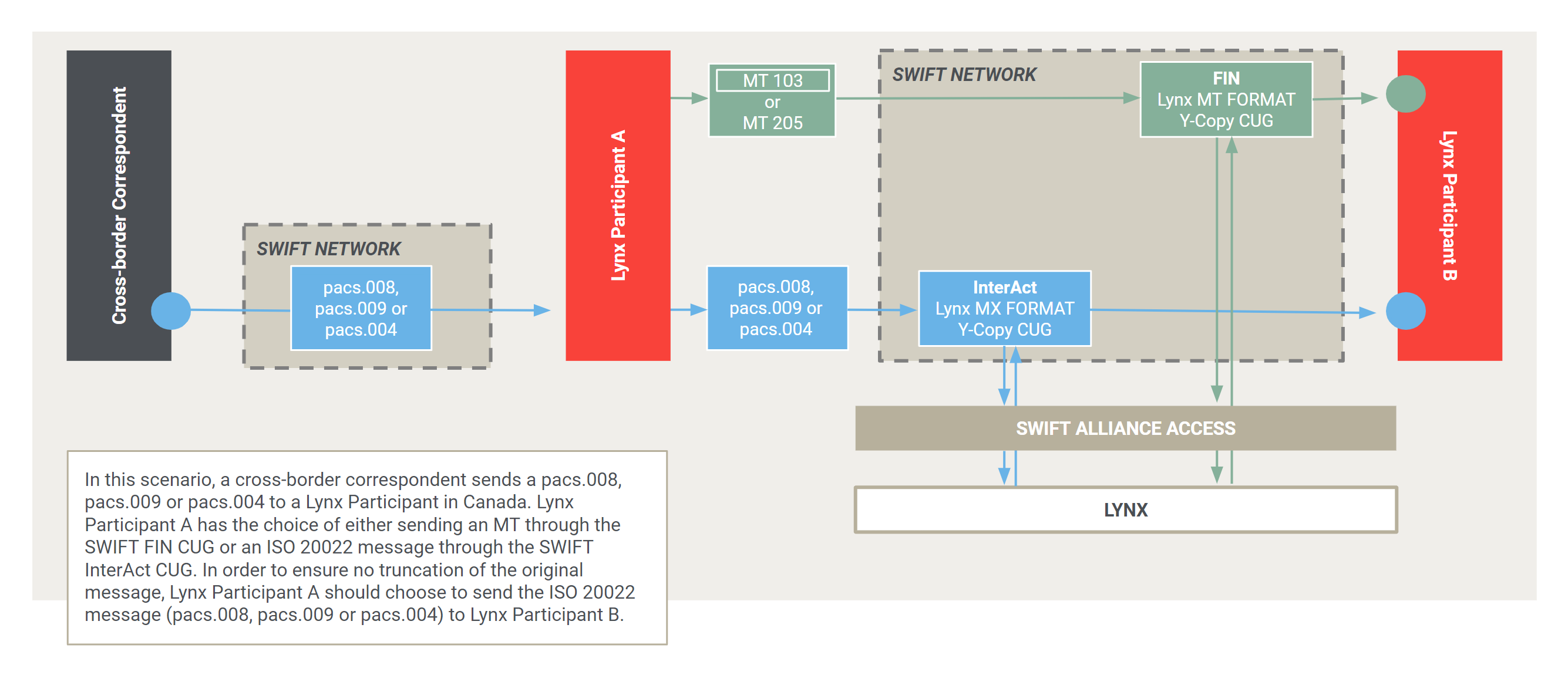

Lynx flow for pacs.008

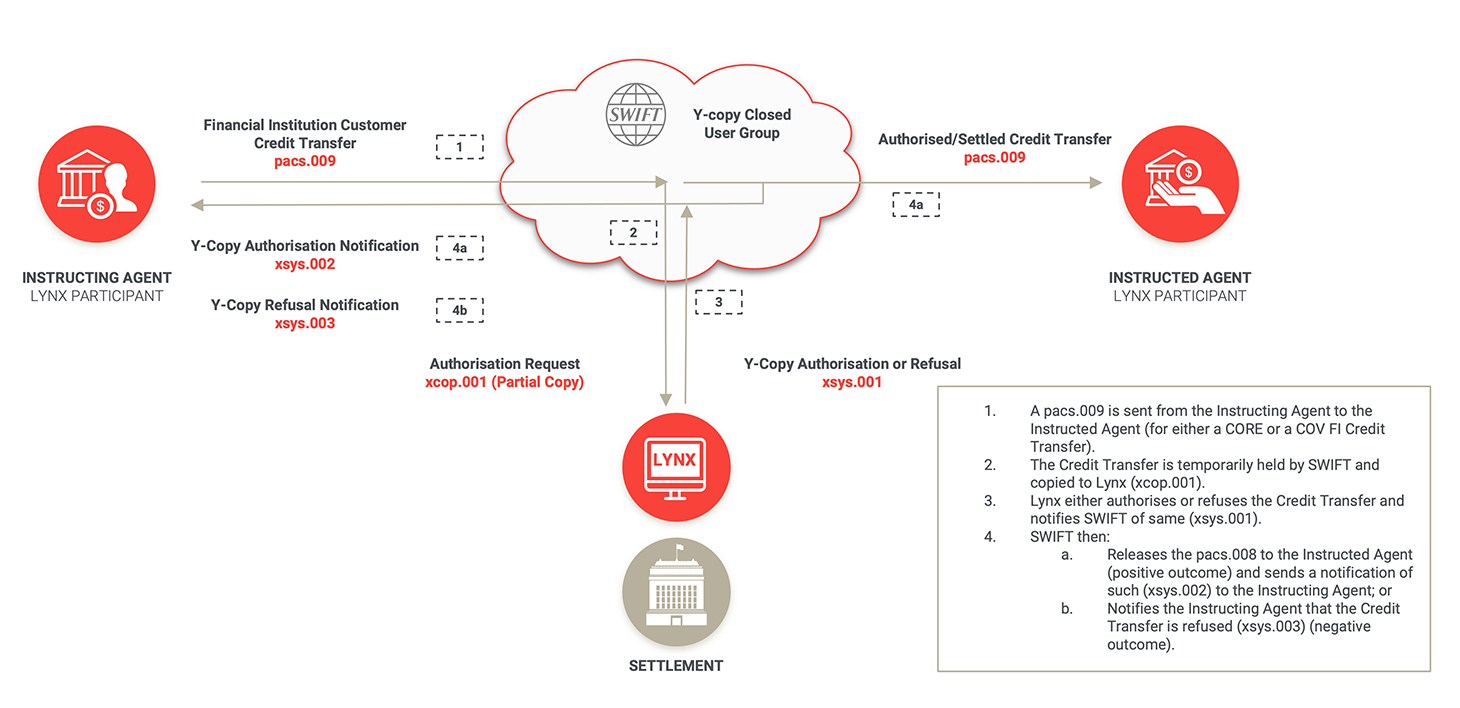

Lynx flow for pacs.009

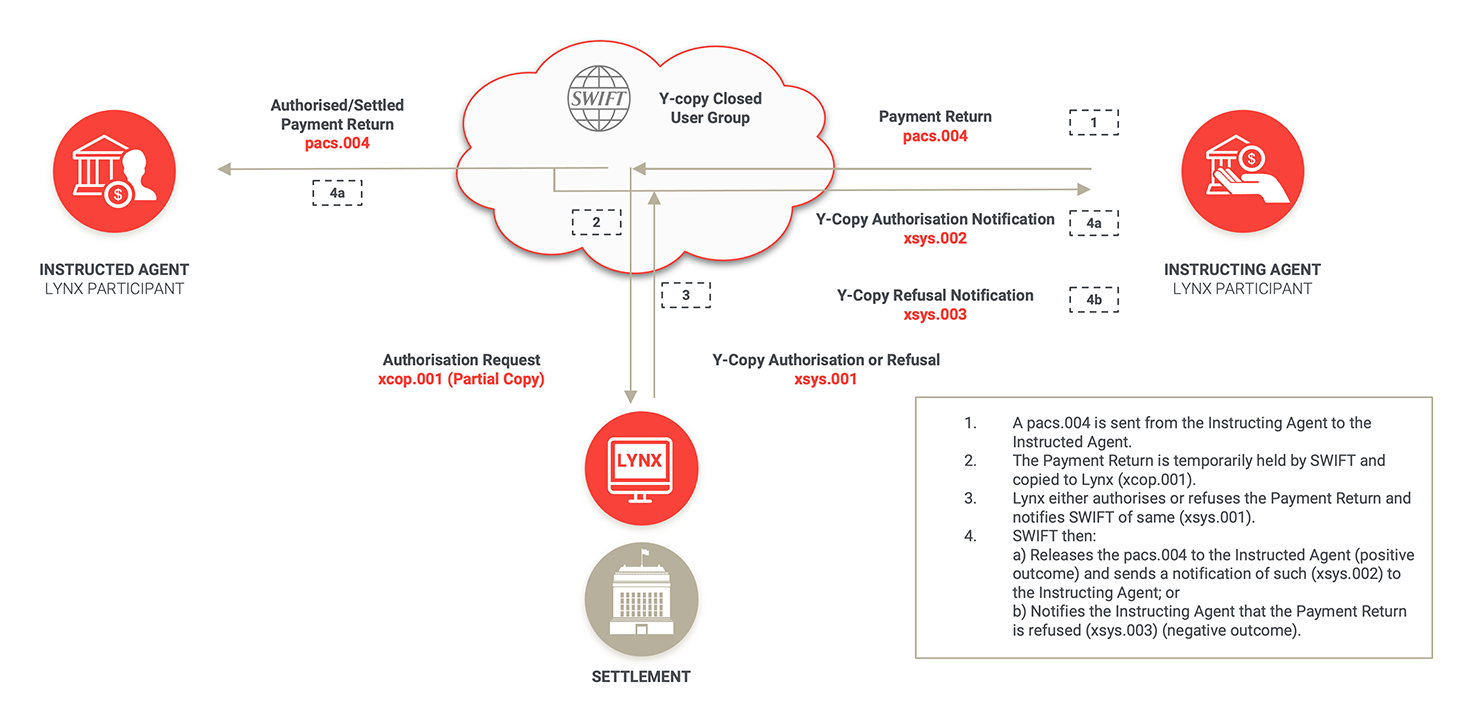

Lynx flow for pacs.004

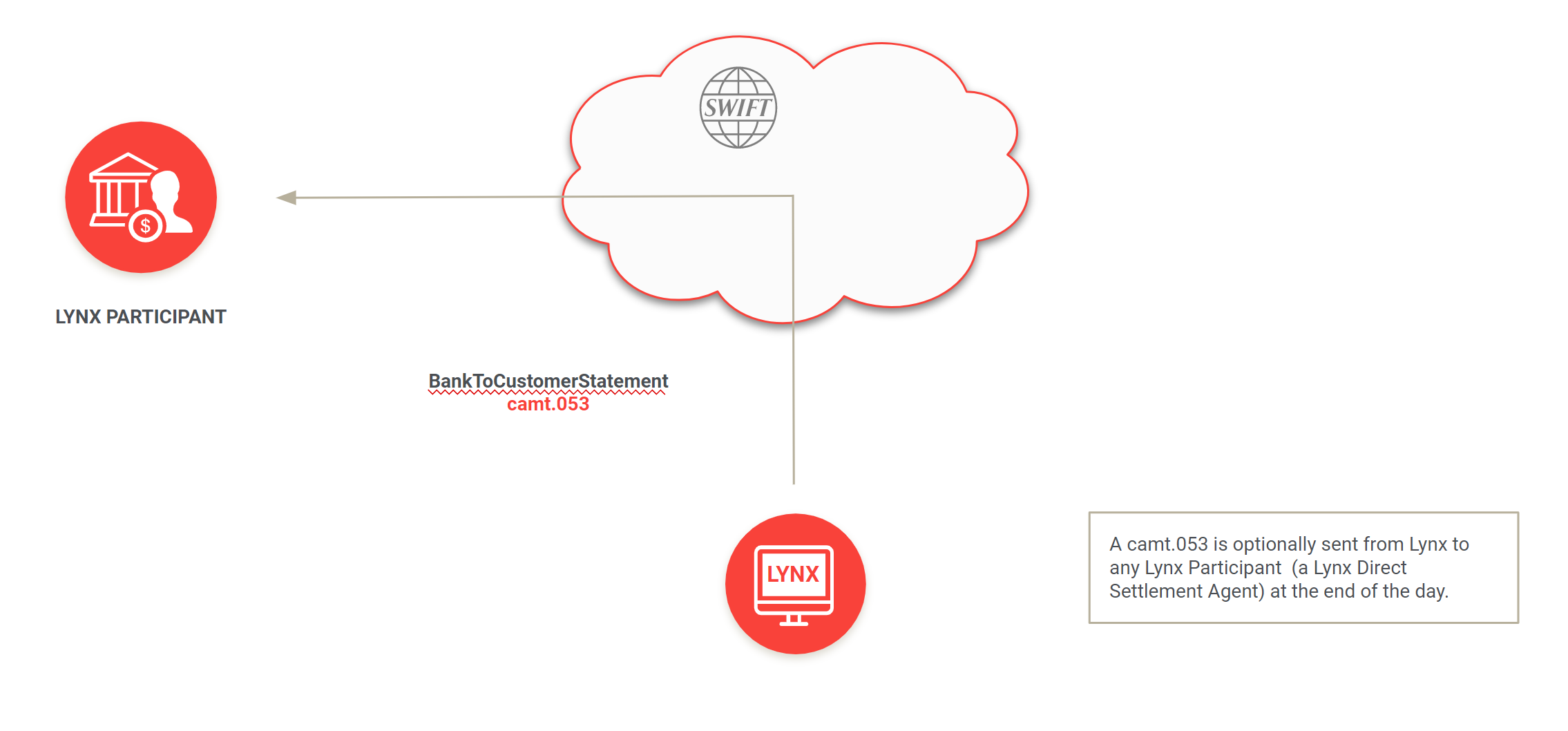

Lynx flow for camt.053

Lynx release two (MT or ISO 20022

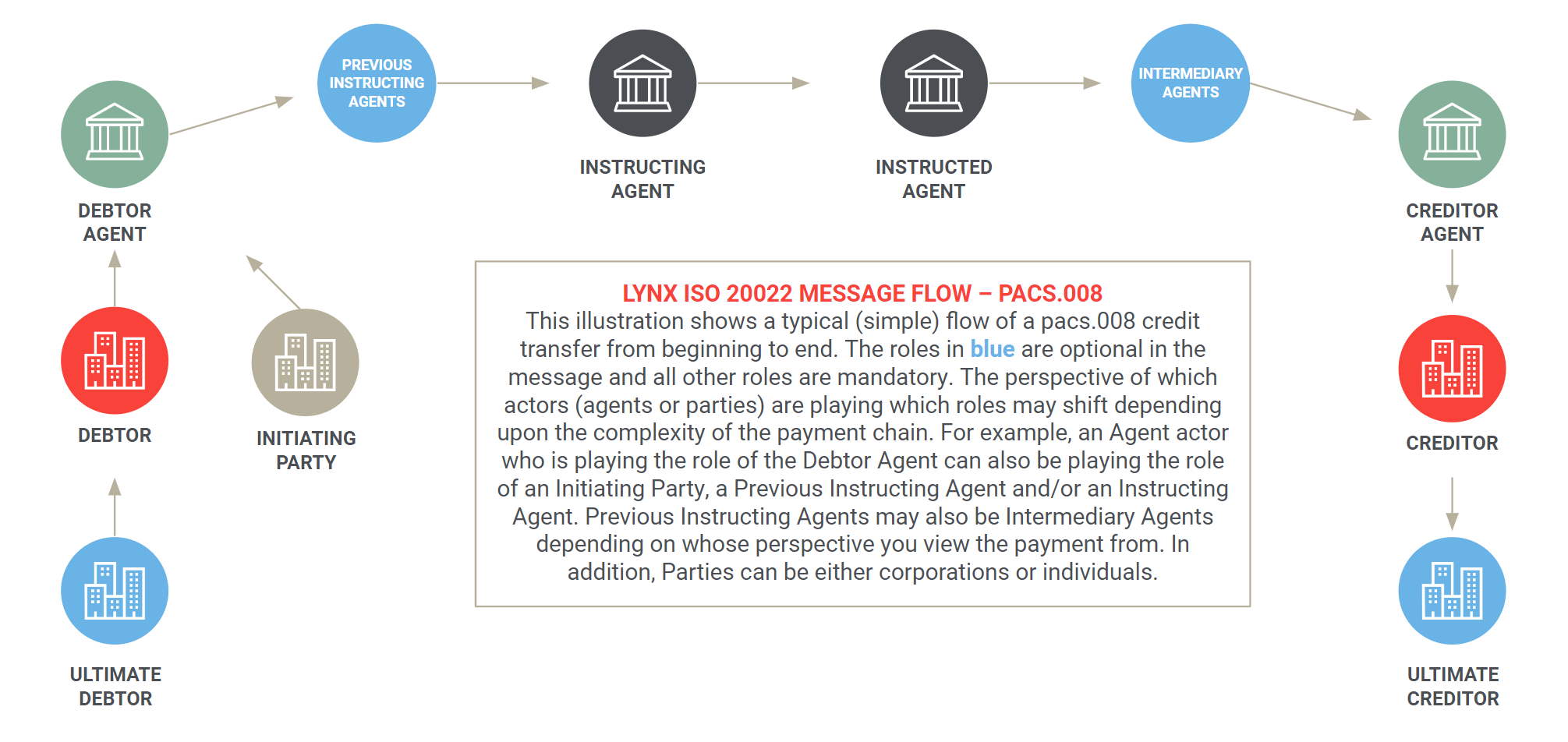

Lynx roles in the ISO 20022 payment chain