Pandemic sparks evolutionary year for payment landscape, reveals new Payments Canada report

Summary

Each year, through the Canadian Payment Methods and Trends (CPMT) report, Payments Canada is able to compile data for its member financial institutions and share knowledge with the larger payment industry to promote a common understanding of payment trends in Canada. The primary objective of the research is to inform readers about the most common domestic consumer and business transactions, providing a holistic view of the Canadian payment market. The CPMT analysis includes ACSS data, external payment service provider data, Canadian market research, and expert analysis.

In 2020, the COVID-19 pandemic deeply impacted the Canadian payment industry. Stay-at-home orders and brick-and-mortar business closures restricted the ability for Canadians to make in-person purchases, and changed the way they transacted when they could. We reported seeing the start of a shift in the payment behaviour of Canadians due to the pandemic in last year’s Canadian Payment Methods and Trends report and in other market research. These changes in payment behaviour persisted throughout 2020 and are captured in this year’s report.

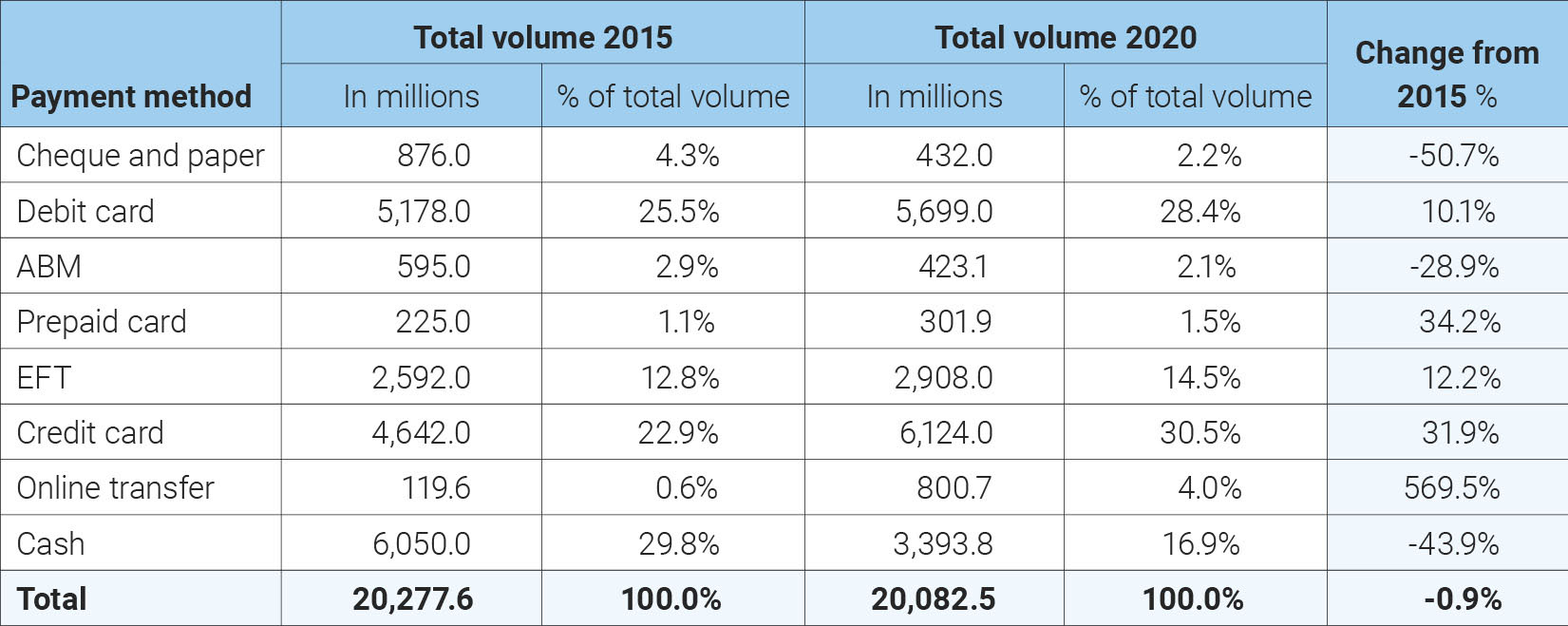

Digital payments volume grew to represent 79 per cent of all transactions in 2020, as consumer appetite for digital transactions fueled growth in online transfers by 48 per cent and e-commerce payments by 20 per cent.

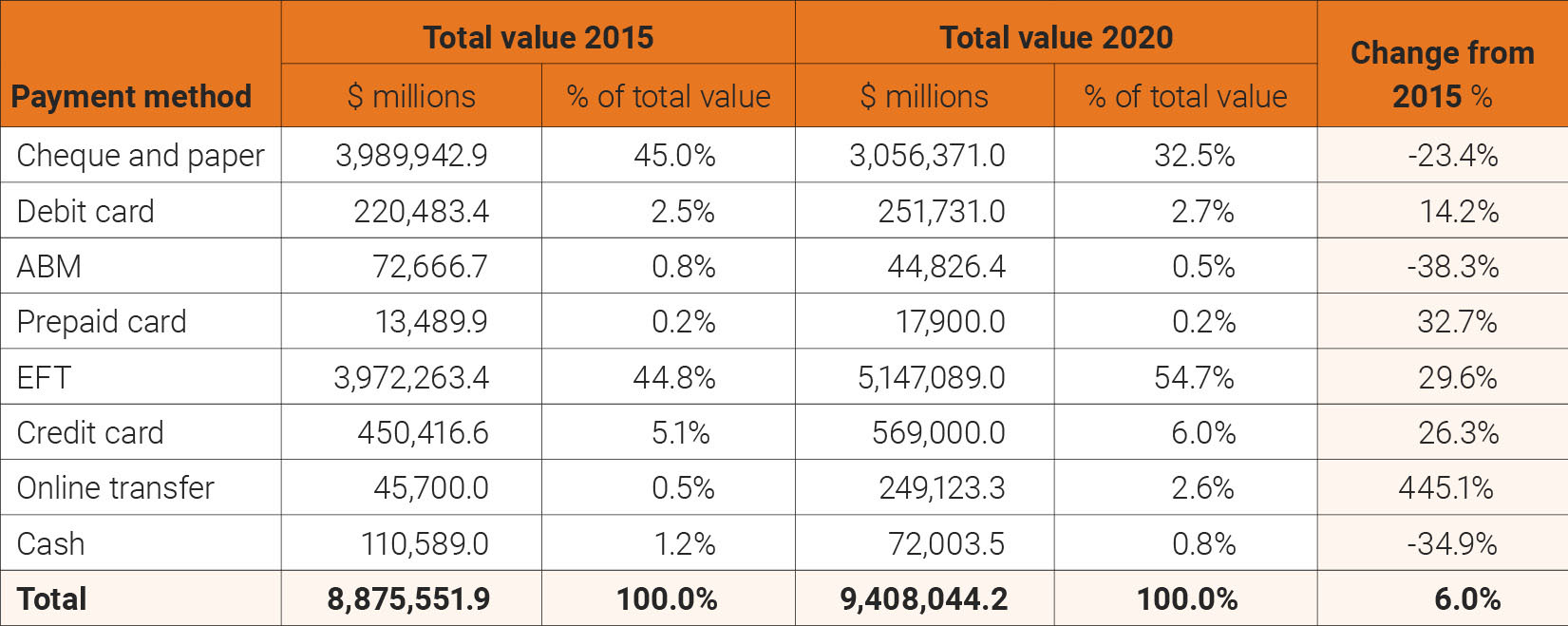

OTTAWA, September 29, 2021 — Today, Payments Canada reveals its annual Canadian Payment Methods and Trends 2021 report, which analyzes 20 billion payment transactions made in 2020, totalling $9.4 trillion, and discusses trends that are transforming the Canadian payment landscape.

“2020 marked a year of accelerated digital adoption fuelled by the pandemic,” said Cyrielle Chiron, Chief Strategy Officer, Payments Canada. “While overall spending decreased due to concerns about the economy and personal spending, Canadians spent more online, evidenced by a significant increase in e-commerce transactions. Government “stay-at-home” orders and brick-and-mortar business closures restricted the ability for Canadians to make in-person purchases — and changed the way they transacted once they could. We also saw a sharp increase in preference for contactless payment options at point of sale, including cards, phones and wearables. There’s no doubt that these shifts in payment preferences are here to stay — and innovation will continue to evolve the payments landscape.”

The 2021 report confirms that the COVID-19 pandemic further accelerated the migration to digital and contactless payments and growth in online transfers, with a commensurate decline in cash and cheques. Unlike the last several years, the data points to negative growth in payment card use. Despite an increase in credit card use as part of an e-commerce boom (which demonstrated 20 per cent year-over-year growth in 2020), credit card use declined by 11 per cent and debit card use declined by nine per cent year-over-year. This is due to a decrease in spending overall in 2020; credit cards remain the most used payment method, followed by debit cards.

“The payment landscape continues to evolve at a rapid pace and the fundamentals of what Canadian consumers and businesses want have not changed,” said Tracey Black, President and CEO of Payments Canada. “Canadians want convenient and secure payment options. Security and efficiency are the guiding pillars for Payments Canada’s continued evolution of Canada’s payments systems.”

Key study findings

- Electronic payments represented 79 per cent of all transactions, compared to 77 per cent in 2019 – accounting for 15.8 billion transactions and representing 66 per cent of total payments value (the combined monetary value of total transactions) in 2020.

- Contactless payments grew dramatically, increasing 13 per cent in volume and 10 per cent in value year-over-year (YOY) in 2020, fuelled by Canadians’ concern about virus transmission and an increase in contactless transaction limits by most networks from $100 to $250. Debit accounted for the majority of all contactless transactions (62 per cent, up 10 percentage points from 2019) with credit accounting for the remainder.

- E-commerce transactions grew by 20 per cent in value, with close to half of Canadians (47 per cent) reporting using e-commerce platforms for online purchases more frequently to purchase a wider range of products compared to pre-pandemic. E-commerce payments accounted for 477 million transactions and generated over $56 billion in value in 2020, compared to $47 billion in 2019.

- Canadians’ use of card alternatives continued to grow. Use of card alternatives (such as smart watches) increased dramatically, generating $244 million in payment transactions in 2020, an increase of 115 per cent and 125 per cent in the volume and value respectively from 2019. Approximately 29 per cent of Canadians made a purchase using a mobile payment or digital wallet; 21 per cent of Canadians made in-app purchases compared to 18 per cent in 2019, and 14 per cent of Canadians made purchases using gaming consoles or Internet of Things (IoT) devices, compared to 15 per cent in 2019.

- Credit card use declined for the first time in seven years, with a 11 per cent decrease in volume and an eight per cent decrease in the value of credit card transactions. This follows a record high in the use of credit cards in 2019. However, credit cards continue to represent the largest share of all payment types in terms of transaction volumes. In 2020, 93 per cent of Canadians reported owning at least one credit card, and the number of credit cards in circulation increased by three per cent overall.

- Debit card use decreased nine per cent in 2020 from 2019 to represent 28 per cent of all transaction volume, but continues to be a key payment method. The vast majority of Canadians have debit cards (97 per cent) with the average transaction value being $44.

- Online transfer growth skyrocketed in 2020, increasing 48 per cent in volume and 40 per cent in value from 2019 and is poised to meet or exceed debit value in the coming years. This growth follows a 40 per cent increase in the use of online transfers from 2018 to 2019, with a staggering growth of 569 per cent over the last five years.

- Cash payments declined by a further 17 per cent, following a nine per cent decrease in 2019. Cash usage accounted for 17 per cent of total payments volume and is expected to continue to decline steadily. Interestingly, 47 per cent of Canadians reported making a cash purchase in the last seven days. Of those who are regular cash users, 38 per cent received a portion of their monthly work income in cash, an increase of eight per cent YOY; in part, this trend is fuelled from the growing gig economy.

- Cheque use continued to decline, while average cheque transaction value increased. Cheque transaction volumes declined by 26 per cent, and transaction values by 15 per cent from 2019. But, the average cheque transaction value was $7,075 (compared to $6,142 from 2019). The year-over-year increase in average cheque transaction value is linked to the continued use of cheques for large value business payments.

Summary of all payment totals by volume and value of transactions over last five years

The Canadian Payment Methods and Trends 2021 report was compiled by Payments Canada with the help of payment service providers, payment consultants and researchers to provide a comprehensive understanding of the Canadian payment landscape in 2020.

For media inquiries, please visit the Media Centre.